Super is one of the most tax-effective ways to save.

You could be thousands of dollars better off by making ‘concessional contributions’, into your super – and, putting more money into your super now, could make a big difference to your retirement lifestyle later.

Make the most of your before-tax contributions

Concessional contributions are contributions made to super, usually with your before-tax salary. For most people concessional contributions are taxed at just 15 per cent – not your marginal tax rate. That’s a big tax cut and puts your money to work – in your super account.

And because your salary is reduced by the amount you contribute, it may even move you into a lower tax bracket, saving you even more.

This financial year, you’re allowed to make $25,000 in concessional contributions. Remember – your employer’s 9.5 per cent compulsory contributions count towards this limit.

So, how much tax could you save?

If you earn $100,000 and put $10,000 into your super, you can benefit by up to $2,400 per year, as the table shows:

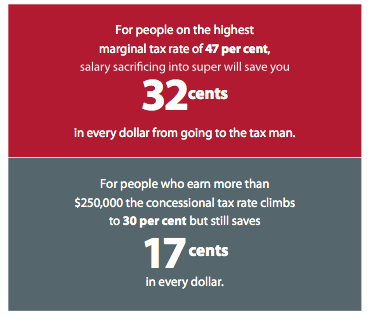

Depending on your salary, the benefit may be even greater:

How can you contribute?

There are two ways you can take advantage of your concessional contributions:

1. Salary sacrifice

You can make an arrangement with your employer to place some of your before-tax salary into your super fund and it will be automatically taxed at just 15 per cent. You can make either a one-off contribution or an ongoing payment. Contact your employer’s payroll department to discuss what you need to do.

2. Make your own contribution

If you’d prefer not to salary sacrifice or if you’re self-employed, you can make your own contribution to super. By electing for the contribution to be treated as a concessional contribution into your super fund you will pay only 15 per cent* tax on the contribution rather than your marginal tax rate.

If you’re considering taking advantage of your concessional contributions or want to understand more about super opportunities please contact us to discuss your options with Omnis Group on 08 9380 3555.

* if you earn more than $250,000 the tax rate is 30 per cent