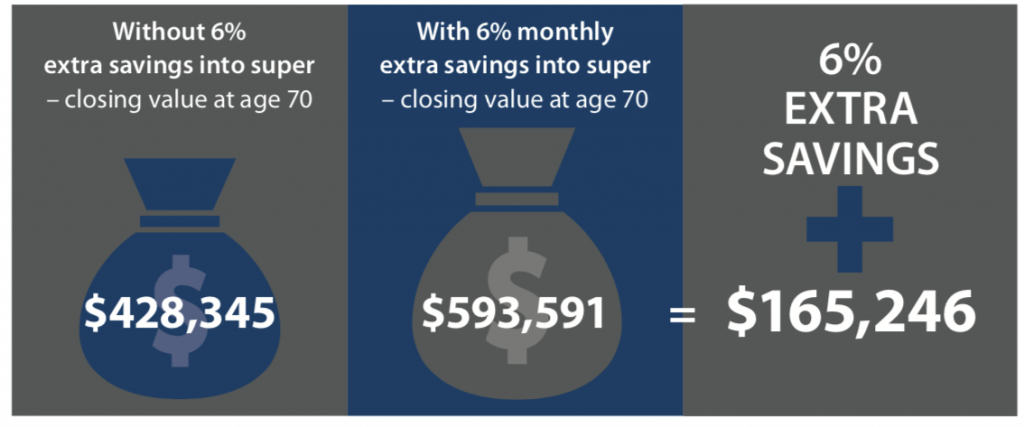

Projected benefits of putting extra savings into super

Age 40

- Starting balance $100,000

- Income of $100,000 per year

As shown in the above case study, putting an extra 6 per cent of your pre-tax income into your super each year could leave you significantly better off in retirement.

How to contribute more to super

There are several ways you can contribute more to super and take advantage of the tax benefits. Here are two:

1. Salary sacrifice through your employer

Most employers will allow you to nominate an amount to be contributed to super from your pre-tax income. This allows you to pay tax on the contribution as it enters your super fund at just 15 per cent3, rather than your marginal tax rate.

2. Make a personal contribution and claim a tax deduction

Since 1 July 2017, you can make voluntary personal contributions to super and claim a tax deduction when you lodge your tax return for that year.

The reality is that many people will not be able to work right up to their age pension age, which makes funding the years between retirement and the age pension age extremely important.

Don’t get caught short in retirement – contact Omnis Group in Subiaco about your retirement plans to make the most of your super.

Related reading

Source: Superannuation calculator – MoneySmart website www.moneysmart.gov.au