Risk and investing are intrinsically linked

In fact, risk is defined as the chance you will lose money on an investment – however, crucially it is also the driver for making money.

As all investments come with varying degrees of risk, it is important to recognise your appetite for risk and build a portfolio that suits your risk tolerance.

There are several factors that measure risk tolerance.

Desire to take risk

Some investors enjoy the inherent uncertainty of investing and are inclined to take on high-risk investments. More common however is an aversion to the stress that a large fall in an investment’s value can produce.

As a test, ask yourself how you would feel if you woke up and the value of your investment had fallen by 10 per cent? 20 per cent?

Financial capacity to take risk

A couple with a new baby and a mortgage will have a considerably different capacity to take risks than a single person just starting out in the workforce.

Your need to take risk

This is tied to your investment time frame. If you are 30 years old and planning 35 years ahead for retirement, you will probably be happy to accept greater risk, as short-term volatility is smoothed out, to achieve your goals.

On the other hand, if you are nearing retirement, you’ll probably not want to risk losing your money as there isn’t the luxury of time to recover from losses.

Risk and return comparison

With greater risk, there is the opportunity for greater returns. Different types of investments, or asset classes, have greater risk and the possibility of higher returns. There are four main asset classes:

- Shares (also known as equities)

- Property

- Fixed interest

- Cash

Each asset class has individual characteristics and carries a different level of risk and return to suit a range of investor types.

Risk and return comparison continued

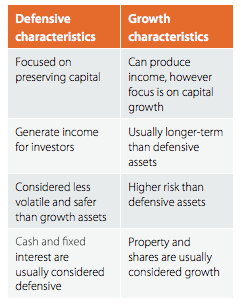

Asset classes fall into two main groups: defensive and growth.

Minimising risk

While risk is an unavoidable part of investing, there are steps you can take to minimise your exposure to unintended risk.

Diversification

As the saying goes, don’t put all your eggs in one basket. Different types of investments, such as shares and bonds, perform well at different times. With a mix of investments,

if one part of your portfolio suffers losses, other investments may retain steady or even appreciate. Over time this will smooth out the returns of your portfolio and protect against the risk of catastrophic losses.

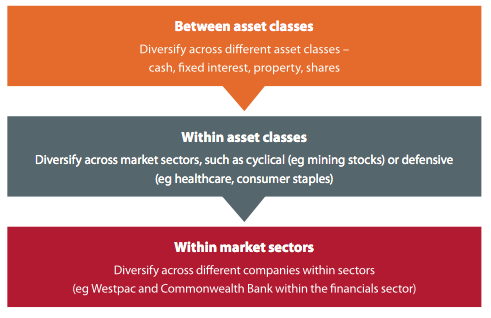

There are different levels of diversification to properly manage risk:

Long-term investments

While your age, investment goals and financial situation will affect where you put your money, generally speaking longer-term investments present smoother returns as short-term volatility is smoothed out.

Research

The more you understand about an investment and the financial markets, the less likely you’ll be to make an investment which doesn’t match your financial goals.

What type of investor are you?

As a part of your financial plan, we help you understand what type of investor you are and what investments are most suitable for your financial goals and attitude to risk.