You may be able to use your super to help make the most of your money

Whether you’re buying your first home or you’re ready to downsize, these two new schemes support the Government’s goal of reducing pressure on housing affordability in Australia.

First home buyers

The ‘First home buyer super saver scheme’ allows you to save for a deposit for your first home using your super account. The benefit of saving within your super is the concessional tax treatment of super which can help you save faster compared to a traditional savings account.

How does it work?

From 1 July 2017, you can make your own concessional and non-concessional contributions into your current super account to save for your first home. There is no need to open a special super account.

From 1 July 2018, you can apply to the ATO to release these contributions, along with the earnings on the contributions, to fund the purchase of your first home when you’re ready.

Who is eligible?

To be eligible you must:

- be 18 or over at the time of applying for the release of your money from super

- have never owned property in Australia, including a home or investment property

- live or intend to live in the property for at least six months of the first 12 months after purchase

- not have withdrawn an amount under this scheme before

Money that can be released from your super account includes:

- your non-concessional (after-tax) contributions

- your concessional contributions, such as salary sacrifice contributions and personal deductible contributions minus 15 per cent contribution tax

- the associated earnings on the above contributions.

Note: The non-concessional contributions must be released before any concessional contributions. Also, super guarantee contributions, spouse contributions and government co-contributions cannot be released.

How much can you save?

The maximum amount you can contribute under the scheme is:

- up to $15,000 from any one financial year, and

- a maximum of $30,000 in total across all years.

- This means a couple saving for a first home could contribute up to $60,000 together

While the non-concessional contributions can be paid tax-free, all associated earnings plus any concessional contributions in a withdrawal will be taxed at your marginal tax rate. But, with a 30 per cent tax rebate from the government this considerably reduces your overall tax liability.

This scheme can benefit you if you make salary sacrifice or personal deductible contributions by:

- reducing your tax liability

- helping you budget via ‘forced savings’, and

- taking advantage of the investment returns which are usually higher than a bank account

Downsizers

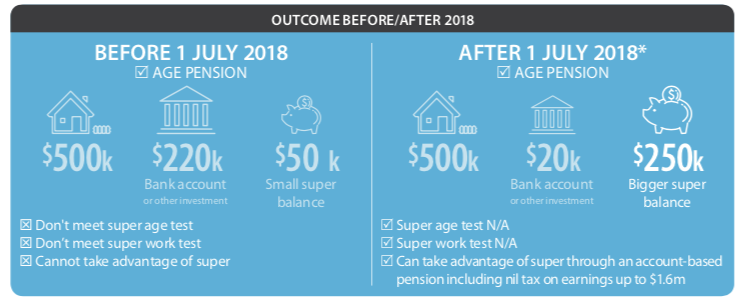

After 1 July 2018, if you’re over 65 and sell your home, you can now put some of the money you receive into your super.

How does it work?

You can use the money from the sale of your house to make a ‘downsizer contribution’ to super of up to $300,000 or $600,000 for a couple.

Who is eligible?

You are eligible to take advantage of this scheme if you are aged 65 or over.

Unlike the non-concessional contributions, the good news is that you don’t need to be working and there are no age limits to making downsizer contributions. Also, the total super balance test of $1.6 million and the $100,000 non-concessional contributions cap restrictions don’t apply which makes it a great option if you want to contribute more to super and are currently ineligible because of these restrictions.

What types of properties are included?

The property must be located in Australia. It does not need to be your current home — it can be your, or your partner’s, former home as long as you or your partner have owned it for more than 10 years and lived in it at some point in your life. An investment property that neither of you have lived in is not eligible. But, the property does not need to be owned by both members of a couple for both of you to make a contribution of up to $300,000 to your super. Unfortunately, the sale proceeds from a houseboat, caravan or mobile home cannot be used.

If you are considering selling your property and are interested in contributing to your super you should hold off selling until after

1 July 2018 as a property sold before this date is ineligible.

Example

For Tom and Hazel it’s time to downsize their $700,000 home to a smaller $500,000 home. After 1 July 2018, for the first time, they have the opportunity to boost their super with the remaining $200,000.

Note: If your family home is currently exempt from the Centrelink assets test and you sell it and put the money into super – your age pension entitlement could be affected.