Did you know the age pension age is increasing?

The age pension age is increasing to 67 which could have a significant impact on the retirement plans for many Australians.

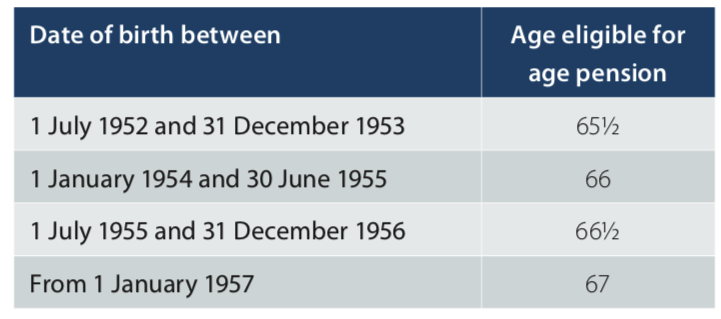

The age you are eligible to receive age pension payments from the Government, depends on your date of birth. That is, the age pension age increases incrementally from age 65 1/2, for those born between 1 July 1952 and 31 December 1953, to age 67 for those born after 1957.

What is your age pension age?

So, if you’re turning 50 this year, ie born in 1968, and you’re planning on retiring at age 60, you will need to use your super and other savings for seven years before you are eligible to apply for the age pension.

Why is the age pension age increasing?

In 1926 only 5 per cent of the Australian population was over age 65. Now approximately 15 per cent of Australians are over age 65(1). And with people living longer, the number of years we’re dependent on the Government to support us in retirement is longer.

In other words, our longevity is putting pressure on the Government’s ability to fund a sustainable welfare safety net. But, this age increase could have serious consequences for people’s retirement plans – forcing many who are fit and able, to work longer and save more for retirement.

How much are you likely to need each year in retirement?

The amount needed each year in retirement is different for everyone but the Association of Superannuation Funds of Australia (ASFA) estimates that a comfortable retirement can cost:

- $44,011 pa for a single person

- $60,457 pa for a couple(2)

This estimation doesn’t take into consideration rent or mortgage repayments that you may still need to make.

What if you run out of money before reaching age pension age?

If you’re unemployed and below the age pension age you can apply for Newstart payments from the Government. However, the Newstart allowance is subject to the Centrelink activity test as well as the income and assets tests.

Your super is an extremely important investment

Your super is an extremely important investment because it’s likely to be your main source of income in retirement, especially during the earlier stages. Super is also the most tax-effective way to save for your retirement, so it makes sense to make the most of the tax advantages. That is, your contributions are taxed at only 15 per cent(3) which can be much lower than most peoples’ marginal tax rate which could be up to 47 per cent.

Your employer’s compulsory 9.5 per cent superannuation guarantee contributions are unlikely to be enough to give you a comfortable retirement. But, if you start contributing more to your super now you can enjoy a more comfortable retirement later.

Don’t get caught short in retirement – contact Omnis Financial Planning in Perth on 08 9380 3555 about your retirement plans and making the most of your super.

- Australian Institute of Health and Welfare ‘Older Australian’s at a glance’ April 2017

- ASFA Retirement Standard

- Note – if you earn $250,000 or more you may pay the higher rate of contributions tax of 30 per cent